Opening soon: The health insurance marketplace

By Samantha White

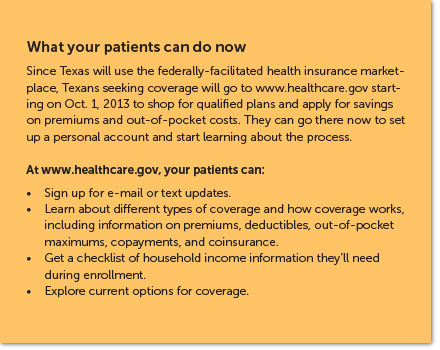

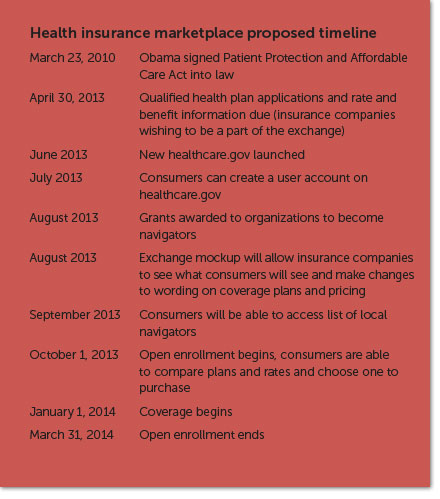

Since the signing of the Affordable Care Act in 2010, you’ve probably had many patients come to you for answers to a host of questions, but you can expect an increase in their queries in the next couple of months. Among other health insurance reforms already put into place by ACA, the health insurance exchanges are scheduled to open for enrollment on Oct. 1, 2013. While pricing and specific details aren’t expected to be released until then, you can begin helping your patients prepare for this new way of purchasing coverage now.

One of the most important things you can tell them about the marketplace is that it is a legitimate and safe place to shop for coverage, as all plans will meet the minimum requirements set by ACA. It will allow them to shop and compare plans in a familiar and easy way, and premium assistance will be available for those who need it. In Texas, this includes individuals and families falling between 100 and 400 percent above the federal poverty line—$11,490 to $45,960 a year for an individual, and $23,550 to $94,200 for a family of four (for a breakdown on income levels and savings, click here).

States were given the option to create and run their own marketplace, but Texas chose to forego this opportunity and instead use the federally-facilitated marketplace currently being created by the Centers for Medicare and Medicaid Services. Whether run by states or by the federal government, all exchanges must allow for open enrollment from Oct. 1, 2013 to March 31, 2014, with coverage beginning as soon as Jan. 1, 2014. Patients will be able to enroll in the exchange and purchase coverage in person, by telephone, fax, or mail, or online at www.healthcare.gov.

These competitive marketplaces will deliver one-stop shopping for affordable health care coverage to thousands of Texans looking for private insurance. All plans offered through the exchange must comply with the minimum requirements set in the ACA, ensuring that all coverage purchased is adequate and affordable. Required minimum benefits include emergency services, prescriptions, hospitalization, and more.

The law also set into place four levels of coverage: bronze, silver, gold, and platinum. The premiums won’t be known until the plans in the marketplace have been announced, but the actuarial values of each level have been set. Bronze plans, for example, will require insurers to pay 60 percent of all costs for an average, healthy person. On the opposite end, platinum plans will cover 90 percent of those costs. Click here to see more on the actuarial values of plans offered in the marketplace.

While insurance companies do not have to offer all four levels of coverage, they do have to give consumers at least one silver and one gold option. Insurance companies wishing to offer plans through the exchange submitted applications in April 2013 to become certified as qualified health plan providers.

Stacey Pogue, senior policy analyst for the Center for Public Policy Priorities, compares the online exchanges to two current and well-known websites—Orbitz, a travel-booking company, and TurboTax, which helps customers file their taxes online. Both sites focus on walking the customer through the process to the point of purchase.

“TurboTax holds your hand,” Pogue says, directing consumers to enter information in the right blanks. At some point in the process, consumers will find out if they are eligible for subsidized coverage offered only in the exchange, Pogue explained.

The federal exchange will also work similarly to Orbitz by allowing users to compare prices before purchasing a plan. “We’ve never been able to compare plans, at all, in any reasonable way,” says Pogue. “What the exchange will do, I think, is somewhat revolutionary in that you’ll be able to see plan A, plan B, plan C, a price for you or your group and pick them based on price.”

There will be two different exchanges in the federal marketplace: one for individuals to purchase coverage and one where small businesses can buy plans to offer employees. They will look similar and will most likely offer comparable plans.

Shopping as an individual

While enrollment does not open until Oct. 1, you can currently visit www.healthcare.gov for information on the functionality of the exchange for individuals. The open enrollment period, beginning Oct. 1, 2013, will end March 31, 2014 for the first operational year, but in subsequent years will not be as long. This is to encourage purchasing coverage now rather than waiting until health insurance is necessary because of a sickness or accident. After open enrollment ends, only those with a qualifying life event—job loss, giving birth, moving to a new state, or divorce—can obtain coverage.

Any citizen except those who are incarcerated can purchase health insurance coverage in the marketplace, but to be eligible for federal subsidies to cover part of the premium cost, patients must not have access to qualified and affordable health insurance through an employer. This is an important point for many middle-class families in which at least one member can receive coverage through an employer. Family coverage through an employer is often very expensive, so will such families qualify for subsidies through the marketplace? Most likely the answer is no.

As long as the employer-sponsored plan in question is considered qualified and affordable by the IRS, a family would not be eligible for premium subsidies. To be “qualified,” a plan must have an actuarial value of at least 60 percent, meaning it would pay for 60 percent of an average family’s annual health care expenses.

To be “affordable,” the employee’s share of the premium for individual coverage cannot exceed 9.5 percent of the total household’s income. For instance, suppose a single mother of two has coverage through her employer that costs 8 percent of her income. To include her children on the plan would increase her total premium to 12 percent of her income. She could not get premium subsidies for policies covering her children through the exchange.

Since Texas declined to expand Medicaid coverage to poor adults, the state is left in an odd situation. Households earning between 100 percent and 400 percent of the federal poverty level will be eligible for government subsidies in the marketplace, but families earning less will not. An estimated 1.3 million Texans are likely to be left without any options to help them obtain insurance.

People with questions about the marketplace now can sign up for e-mail and text message updates at www.healthcare.gov, or call the toll-free hotline at (800) 318-2596. Once the marketplace is open, individuals will be able to get assistance from community navigators.

Navigators

All health insurance exchanges are also required to create a navigator program to provide free assistance for patients wishing to enroll and establish eligibility in the marketplace. These programs will be funded through federal and state grants and will typically be well-known community organizations. They must be impartial to all individuals and employers looking to utilize the exchange.

“It’s their job to, at no cost to you, provide services to help you go step by step and get enrolled,” Pogue says. Organizations receiving grants to become qualified navigators will complete ample training and be announced before open enrollment begins to assist with determining eligibility. Once open enrollment begins, they will walk consumers through enrollment and help them choose a plan. Consumers with a more complicated family or income—step children or freelance income for example—will have a more lengthy and complex process. They will be perfect candidates to use navigators.

According to CMS, navigators will also “provide outreach and education to raise awareness about the marketplace.” Organizations serving as navigators were announced in August. You can find out which organizations they are in your community at www.cms.gov and offer them as resources to those patients with complicated questions.

Shopping as a small business owner

Linda Carter, benefits consultant with Texas Benefit Solutions, says that while there is plenty of information on the individual marketplaces, not much has been revealed about the Small Business Health Options Program, or SHOP. The basics we do know might be helpful to physicians running small businesses, but we will find out more as the Oct. 1 deadline nears.

For businesses with 50 or fewer full-time-equivalent employees, SHOP will streamline the insurance purchasing process and, like the individual exchange, will allow you to compare plans and pricing for your employees. CMS says that by 2016, employers with up to 100 full-time employees will also be able to use the small business marketplace.

When the exchange opens in October, employers will have to choose a single plan to offer employees. However, CMS plans on changing the dynamics of SHOP to allow employers the opportunity to offer multiple plans to employees. According to what Carter has heard, by 2015 the SHOP exchange will function closer to the individual marketplace, allowing employees to pick and choose from a number of plans offered by their employer.

While you do not have to offer coverage to part-timers, they do count toward your total number of employees in determining your eligibility. Some states will require that at least 70 percent of full-time employees must enroll in the SHOP plan, excluding those with coverage through another employer plan, Medicare, Medicaid, or a military program. Carter said that it is still unclear if Texas will be one of those states. Self-employed individuals with no employees can use the individual marketplace to purchase coverage for themselves.

Small business owners can also currently visit www.healthcare.gov to learn more about the small business exchange. Contrary to the individual market, SHOP will not have an initial open enrollment period. Employers can enroll beginning Oct. 1, 2013 with coverage beginning as soon as Jan. 1, 2014, but will also be able to enroll at any point in 2014.

Businesses with fewer than 25 full-time employees making $50,000 a year or less on average may be eligible for a Small Business Health Care Tax Credit. To qualify, you must offer coverage through SHOP and pay at least half of your employees’ premium costs. If you qualify, the tax credit can be worth up to 50 percent of your payment toward premiums, or 35 percent if you are a tax-exempt employer. For businesses smaller than 10 full-time employees, the tax credit can be even larger. Click here to see how the Small Business Health Care Tax Credit works.

If you currently get a tax credit by offering health care to your employees, know that starting in 2014 these tax credits will be available only to those offering a plan through SHOP. Employers not using SHOP to offer coverage will still be able to deduct health insurance costs, but will no longer be eligible for the health care tax credit subsidies. To find out now if your small business qualifies for a health care tax credit, go to www.irs.gov/uac/Small-Business-Health-Care-Tax-Credit-for-Small-Employers.

As trusted members of your communities, know that patients will come to you with questions regarding the marketplace and the mandate in general. As Oct. 1 nears and more information is released, TAFP will update you on the latest news regarding the individual exchanges, the SHOP marketplace, and navigators across the state.